Explore SMSF Property Investment Opportunities

Michael, Danya and the team at Inner Circle Finance have been amazing. Best broker experience I have had so far. Everything was explained ahead of time and communication was on point at every step of the way. Would highly recommend to anyone looking for a finance broker to contact Michael.

- James McCauley

We have used Michael from Inner Circle Finance a few times now. He is always great to deal with and steps you through the process. I would definitely recommend Inner Circle Finance Group if you are thinking of refinancing.

- Gina Mienert-Browne

Michael Eid and the amazing Dayna Zernike have been wonderful in helping us refinance our home and investment property loan with a better interest rate. Dayna was so patient with my many emails and Michael has always been available to answer any questions or concerns. The follow up and making sure everything runs smoothly has been outstanding.

- Bronwyn Thompson

Find Your Best SMSF Property Investment Rates and Deals

- Specialised lending knowledge. Our team understands the unique requirements of SMSF property loans and LRBA structures, helping streamline your application process.

- Extensive lender network. Tap into our network of SMSF-specialist lenders. Each is vetted for competitive rates and an understanding of unique SMSF requirements.

- Coordinated approach. We work alongside your chosen financial advisors, accountants, and SMSF administrators to help facilitate a smooth lending process.

Consider Your SMSF's Property Investment Potential

Mindful Loan Structuring

- Specialised LRBA arrangement guidance

- Clear documentation requirements

- Assistance with the application process with SMSF-friendly lenders

Lending Support

- Access to specialised SMSF property loan options

- Coordinated approach with your mortgage specialist

- Dedicated support throughout your application

Property Loan Considerations

- Understanding of SMSF property lending criteria

- Straightforward communication of loan requirements

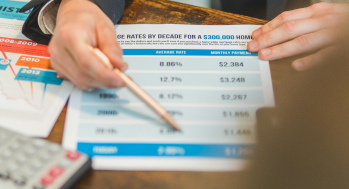

- Assistance in comparing the best interest rates on property mortgages

Smart Money Management

- Loan-to-Value Ratio (LVR) options for SMSF lending

- Transparent fee and rate discussions

- Future lending capacity assessment

Service Excellence

- Direct access to SMSF lending specialists

- Regular progress updates

- Proactive issue resolution

Greater Flexibility and Control

- Get more control over personalised computations and structures

- Keep track of potential tax benefits

- Access more options on loan repayments and SMSF investment rates

SMSF lending specialists ready to assist smart property investors like you

Residential SMSF Loans

- We’ll guide you through every LRBA requirement, from paperwork to approval

- Tap into our network of SMSF lenders for competitive rates you won’t find elsewhere

- Skip the delays with our verified application process

Commercial Property Loans

- Turn your business property goals into reality with structured SMSF finance options

- Get approval to your commercial space faster with expert LRBA guidance

- Feel confident with a mortgage solution that fits your SMSF investment strategy

Frequently Asked Questions

Yes, you can purchase investment property through your SMSF, following strict compliance rules and regulations. The property must be for investment purposes only and cannot be lived in by you or your family members.

Your SMSF Property Investment Journey Starts Now

Our ICFG specialists wil help you understand:

Current SMSF loan rates and terms

LRBA structure requirements

Property loan eligibility criteria

Work with our experienced brokers to understand SMSF property loan applications process. We collaborate with licensed financial advisors, accountants, and SMSF administrators to support your lending needs.

Disclaimer: This is general information only. Please consult your licensed financial advisor, accountant, or SMSF specialist for specific advice about SMSFs and retirement planning.

Company

Contact Us

- 1300 ICFG 88 / 1300 423 488

- support@icfg.com.au

-

Suite 88 3 Clunies Ross Court

Eight Mile Plains QLD 4113